As teams grow, it is easy to get lost down a rabbit hole when dealing with HR, payroll, benefits and compliance issues. Especially because owning a business doesn't automatically make you an expert in these matters. While these things are super important to long-term success, we also know from experience that if we can keep teams focused on their core competencies that business growth accelerates. We encourage you to take a few minutes to learn more about PEOs and how they can help your business thrive.

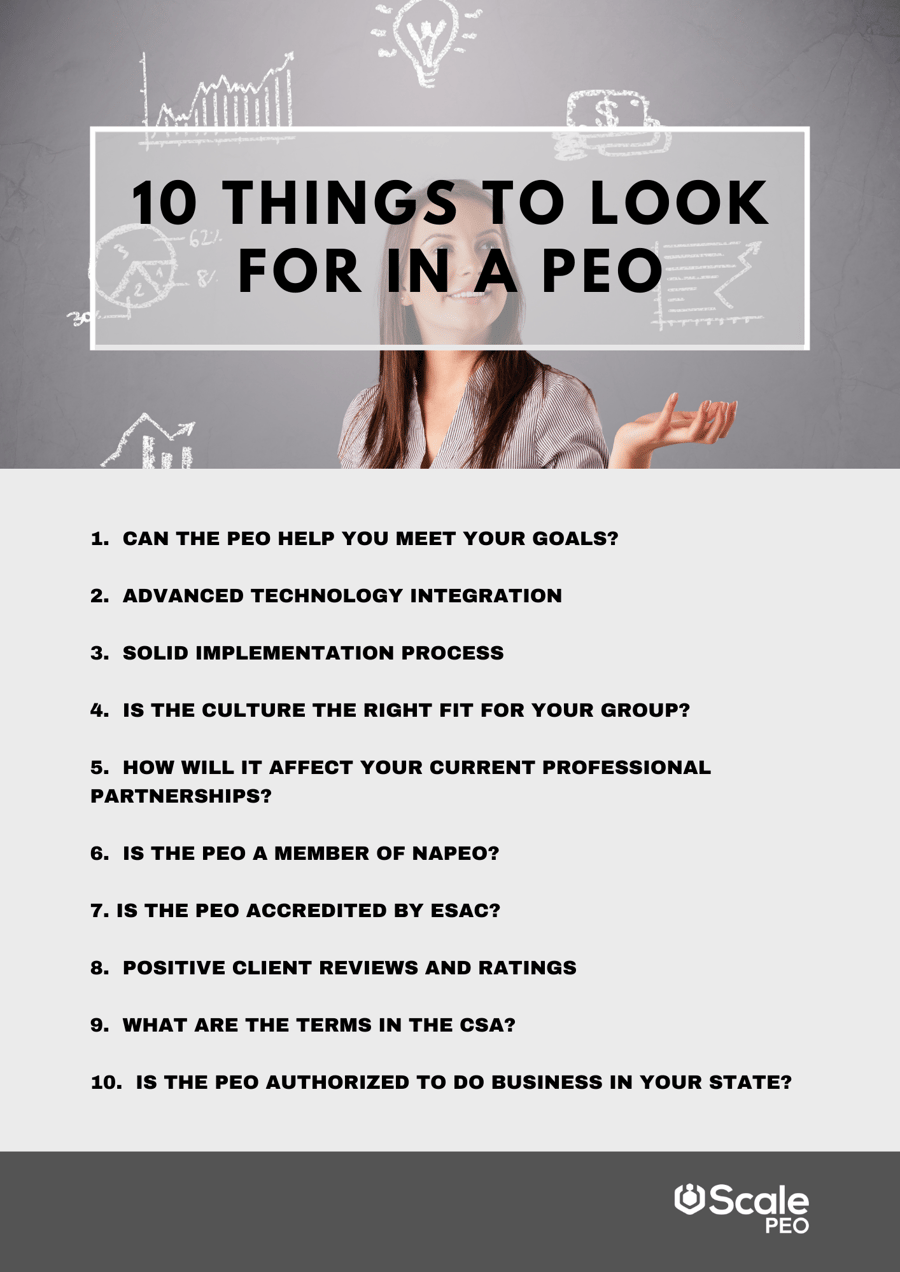

You may be asking yourself, "But what should I be looking for in a PEO?" To that end, here are ten things to look for when selecting a PEO to work with.

10 things to look for in a PEO

1. Make a list of your top goals for working with a PEO. Does the PEO meet your needs? Do they have the services, tools, and support that matches your HR, payroll, benefits, compliance and risk management needs?

2. Inquire about the PEO’s technology. For example, what security protocols are in place? Are any of the tools mobile compatible? What functionalities will employees be able to access? Is payroll integrated with timekeeping?

3. Ask about their implementation timeline and initial onboarding process. Find out if there are dedicated contacts for each service or if you will be working with a team. How are you able to communicate with these people?

4. Meet with the key players you will be working with once the sales process is complete. Don’t forget to ask about their professional certifications and experience. Think about how you feel talking with this people and if it seems like the right fit for your company.

5. Research how bringing on a PEO will affect your current professional relationships. Will your insurance broker be involved? How will partnering with the PEO affect your current HR employee(s), or your payroll administrator? Are you required to sever any of these relationships?

6. Check if the PEO is a member of NAPEO, the national trade association of the PEO industry. You can access their Find a PEO search tool here.

7. Check if the PEO has been accredited by the Employer Services Assurance Corporation (ESAC). ESAC’s accreditation provides verification of a service provider’s ongoing compliance with important financial, operational and ethical industry standards, government regulations and financial assurance. ESAC accreditation is the industry gold standard and around only 5% of PEOs have earned this distinction.

8. Ask the PEO for client references and check online for reviews. These reviews can give you a better overall picture of what it will be like to work with this team.

9. Review the Client Service Agreement (CSA) carefully and ensure everything is clear regarding the allocation of responsibilities. Also review any service guarantees, and the cancellation terms.

10. Confirm if the PEO is authorized to do business in your state, and that they meet all of your state’s requirements.

We hope this list of the top ten things has given you insight into your current situation and what steps to take next. Want to learn more? Check out this hub for all things PEO that we made to help you on your journey! Remember, as you search for the solutions to your payroll, benefits and HR issues, do not let yourself be distracted away from your core competencies. Instead, connect with a trusted partner and advisor who will help you get back on track, and get your team back to doing the things they were hired to do. Ready to take the next step? Reach out today to see if ScalePEO is the solution for you.

.png?width=900&name=10%20things%20cta%20(1).png)